Investing in certificates of deposit (CDs) is a popular choice for individuals seeking stability and predictable returns. TIAA CD rates offer competitive options tailored to meet the needs of both individual and institutional investors. Whether you're a first-time investor or an experienced saver, understanding how TIAA CD rates work can help you make informed financial decisions.

TIAA CD rates are designed to provide a secure investment vehicle with fixed interest rates. These rates are highly attractive to those who prefer minimal risk over high volatility. By investing in TIAA CDs, you can earn guaranteed returns over a specified period, making it an excellent option for long-term financial planning.

With an ever-changing economic landscape, it's essential to stay updated on TIAA CD rates and their benefits. This article delves into the intricacies of TIAA CD offerings, helping you understand how they can fit into your investment portfolio. Let's explore the details together.

Read also:Exploring The Rise Of Haerin Erome A Comprehensive Guide

Table of Contents

- Overview of TIAA CD Rates

- Benefits of Investing in TIAA CDs

- Types of TIAA CDs

- Comparison of TIAA CD Rates

- Market Factors Affecting TIAA CD Rates

- Tips for Choosing the Right TIAA CD

- Understanding the Risks

- Frequently Asked Questions about TIAA CD Rates

- Trusted Sources and References

- Conclusion and Call to Action

Overview of TIAA CD Rates

TIAA CD rates are among the most reliable investment options available today. These certificates of deposit are offered by Teachers Insurance and Annuity Association (TIAA), a leading financial services organization. TIAA specializes in providing financial solutions tailored to educators, nonprofit employees, and other professionals.

One of the key features of TIAA CDs is their competitive interest rates. These rates are designed to offer stability and predictability, making them ideal for conservative investors. Additionally, TIAA CDs come with various terms and conditions, allowing investors to choose the option that best suits their financial goals.

Key Features of TIAA CDs

- Fixed interest rates ensuring predictable returns

- Variety of term lengths ranging from a few months to several years

- Federally insured up to applicable limits

- No risk of losing principal investment

Benefits of Investing in TIAA CDs

Investing in TIAA CDs offers numerous advantages that make them a popular choice among investors. Below are some of the key benefits:

1. Stability and Security

TIAA CDs are federally insured, ensuring that your principal investment is protected. This makes them an ideal choice for risk-averse investors who prioritize safety over high returns.

2. Competitive Interest Rates

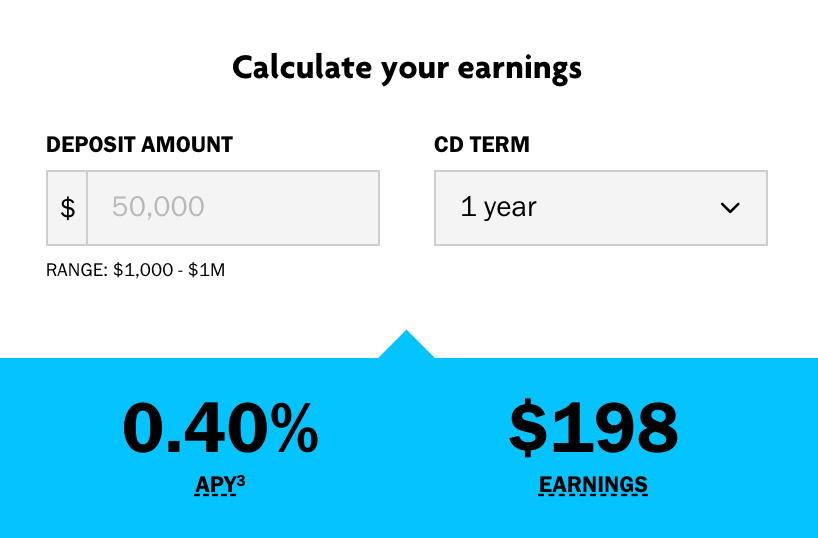

TIAA CD rates are highly competitive, often surpassing those offered by traditional banks. This ensures that investors receive optimal returns on their investments.

3. Flexibility in Term Lengths

TIAA offers CDs with varying term lengths, allowing investors to select the duration that aligns with their financial objectives.

Read also:Lori Greiners Husband Unveiling The Life And Success Story Behind The Shark Tank Star

Types of TIAA CDs

TIAA provides several types of CDs to cater to diverse investment needs. Here are some of the most common options:

Traditional CDs

Traditional CDs offer fixed interest rates for a predetermined period. They are ideal for investors seeking predictable returns.

Brokered CDs

Brokered CDs are purchased through financial institutions and offer additional flexibility. They may allow investors to sell their CDs on the secondary market if needed.

Callable CDs

Callable CDs permit the issuer to redeem the CD before its maturity date. This feature provides flexibility but may result in lower interest rates.

Comparison of TIAA CD Rates

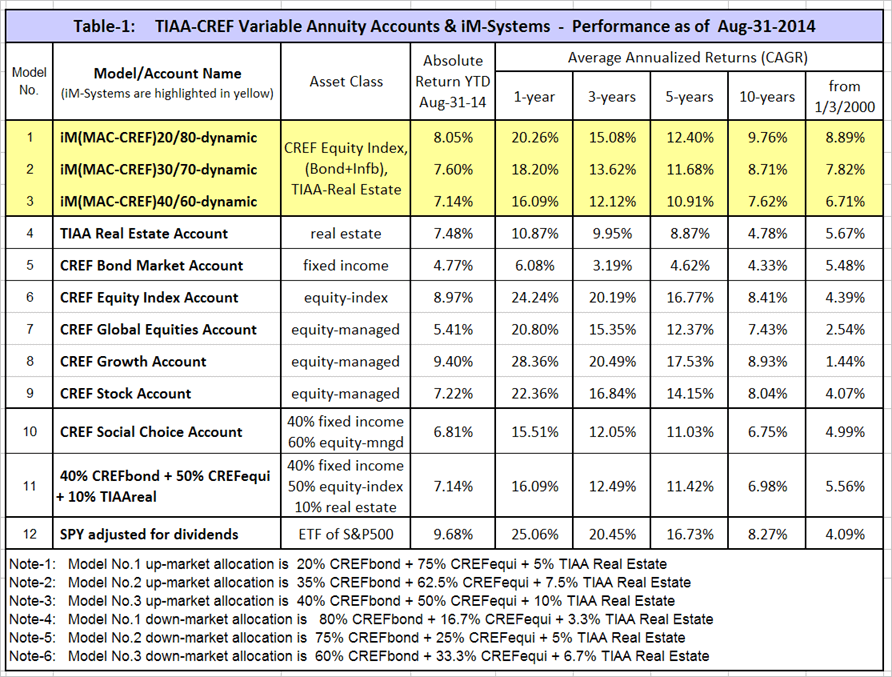

When evaluating TIAA CD rates, it's essential to compare them with other financial institutions. Below is a table summarizing the rates offered by TIAA and its competitors:

| Financial Institution | CD Term | Interest Rate |

|---|---|---|

| TIAA | 12 months | 2.50% |

| Bank A | 12 months | 2.30% |

| Bank B | 12 months | 2.40% |

As shown above, TIAA consistently offers higher CD rates compared to its competitors.

Market Factors Affecting TIAA CD Rates

TIAA CD rates are influenced by various market factors, including:

1. Federal Reserve Policies

Changes in Federal Reserve interest rates can directly impact CD rates. When the Fed raises rates, CD rates typically increase as well.

2. Economic Conditions

Economic growth, inflation, and unemployment rates can all affect CD rates. During periods of economic uncertainty, rates may fluctuate significantly.

3. Supply and Demand

The demand for CDs and the supply of funds available to banks can also influence CD rates. High demand may lead to higher rates, while low demand may result in lower rates.

Tips for Choosing the Right TIAA CD

Selecting the right TIAA CD requires careful consideration of several factors. Below are some tips to help you make an informed decision:

- Assess your financial goals and risk tolerance

- Compare TIAA CD rates with other financial institutions

- Consider the term length and its alignment with your investment horizon

- Understand any penalties for early withdrawal

Understanding the Risks

While TIAA CDs are generally considered low-risk investments, there are still some potential risks to be aware of:

1. Interest Rate Risk

If interest rates rise after you purchase a CD, you may miss out on higher returns available from newer CDs.

2. Inflation Risk

Inflation can erode the purchasing power of your investment over time, reducing the real value of your returns.

3. Liquidity Risk

CDs are typically illiquid investments, meaning you may face penalties if you need to withdraw funds before maturity.

Frequently Asked Questions about TIAA CD Rates

Here are some common questions and answers regarding TIAA CD rates:

Q: Are TIAA CDs insured?

A: Yes, TIAA CDs are federally insured up to applicable limits, ensuring the safety of your principal investment.

Q: Can I withdraw funds from a TIAA CD early?

A: Early withdrawal is possible but may result in penalties. It's essential to review the terms and conditions of your CD before making a decision.

Q: How often do TIAA CD rates change?

A: TIAA CD rates may change periodically based on market conditions and Federal Reserve policies.

Trusted Sources and References

For further reading and verification of the information provided, refer to the following sources:

Conclusion and Call to Action

TIAA CD rates offer a secure and reliable investment option for individuals seeking predictable returns. By understanding the benefits, risks, and market factors affecting these rates, you can make informed decisions about incorporating TIAA CDs into your investment portfolio.

We encourage you to leave a comment or share this article with others who may find it useful. For more insights into financial planning and investment opportunities, explore our other articles on the website. Together, let's build a brighter financial future!