Understanding how much net worth you or others possess is a critical aspect of financial literacy. Net worth is more than just a number; it represents your financial health and overall economic standing. Whether you're an individual aiming for financial independence or a business owner striving for growth, knowing your net worth is essential. In today's world, where financial literacy is increasingly important, understanding net worth is not just an option—it's a necessity.

When we talk about "how much net worth," we often delve into the intricate details of assets, liabilities, and investments. This concept plays a pivotal role in shaping one's financial future. Whether you're an entrepreneur, investor, or just someone trying to manage personal finances, grasping the nuances of net worth is key to achieving long-term financial success.

In this article, we will explore the concept of net worth in-depth, covering its significance, how to calculate it, factors that affect it, and strategies to increase it. By the end, you'll have a comprehensive understanding of how much net worth matters and how to improve yours over time.

Read also:Exploring The Fascinating World Of 10 Atmospheres A Comprehensive Guide

Table of Contents

- What is Net Worth?

- How to Calculate Net Worth

- Why is Net Worth Important?

- Factors Affecting Net Worth

- Strategies to Increase Your Net Worth

- Net Worth by Age

- Net Worth of Celebrities

- Common Mistakes in Managing Net Worth

- Financial Planning for Net Worth Growth

- Conclusion

What is Net Worth?

Net worth is essentially the value of everything you own, minus any debts or liabilities you owe. It serves as a snapshot of your financial health at a given moment. Understanding what net worth is can help you make informed decisions about your financial future.

For example, if you own a home valued at $500,000 and have a mortgage balance of $300,000, your net worth from that asset alone would be $200,000. This simple calculation applies to all your assets and liabilities, giving you a clear picture of your overall financial standing.

Defining Assets and Liabilities

- Assets: Items of value that you own, such as real estate, investments, and savings.

- Liabilities: Debts or financial obligations, including mortgages, loans, and credit card balances.

How to Calculate Net Worth

Calculating your net worth involves a straightforward process of listing all your assets and liabilities, then subtracting the total liabilities from the total assets. This formula is universally accepted and provides an accurate measure of your financial position.

Here’s a step-by-step guide:

- Make a list of all your assets, including cash, investments, property, and other valuable items.

- Estimate the current market value of each asset.

- Sum up the total value of all assets.

- Next, list all your liabilities, such as loans, credit card debt, and mortgages.

- Calculate the total amount of liabilities.

- Subtract the total liabilities from the total assets to determine your net worth.

Tools for Calculating Net Worth

There are various tools and apps available to help you calculate your net worth easily. Some popular options include:

- Mint

- Personal Capital

- Excel spreadsheets

Why is Net Worth Important?

Net worth is a crucial indicator of financial health. It provides insight into your ability to withstand economic challenges and achieve long-term financial goals. A positive net worth signifies financial stability, while a negative net worth indicates potential financial distress.

Read also:Jolan And Anna A Journey Of Love Passion And Success

Additionally, understanding your net worth helps you:

- Plan for retirement

- Make informed investment decisions

- Set realistic financial goals

Net Worth and Financial Independence

Achieving financial independence often correlates with having a substantial net worth. By consistently increasing your net worth, you can create a cushion that supports your lifestyle even after retirement or during periods of unemployment.

Factors Affecting Net Worth

Several factors can influence your net worth over time. These include:

- Income level

- Spending habits

- Investment performance

- Economic conditions

For instance, a booming stock market can significantly increase your net worth if you have substantial investments. Conversely, a recession or poor investment choices can decrease it.

The Role of Inflation

Inflation can erode the purchasing power of your assets over time. Therefore, it's essential to consider inflation when calculating and planning for your net worth.

Strategies to Increase Your Net Worth

Boosting your net worth requires a combination of smart financial decisions and disciplined actions. Here are some effective strategies:

- Save consistently and build an emergency fund

- Invest in diversified assets

- Pay down high-interest debt

- Increase your earning potential through education or career advancement

Implementing these strategies can lead to significant improvements in your financial standing over time.

Building Wealth Through Investments

Investments play a pivotal role in growing your net worth. Whether it's through stocks, real estate, or retirement accounts, strategic investments can compound your wealth over the years.

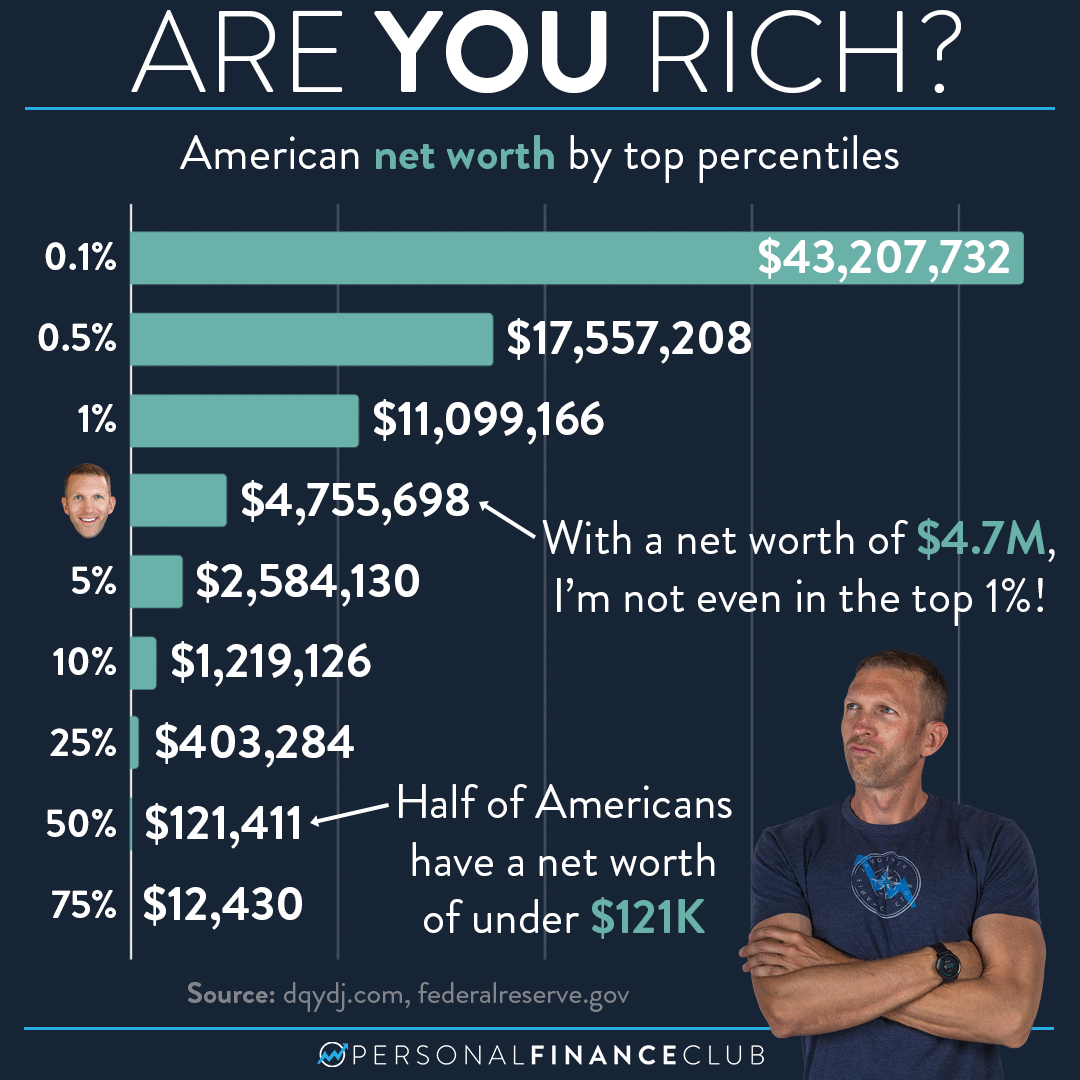

Net Worth by Age

Net worth varies significantly across different age groups. According to the Federal Reserve, the median net worth for households under 35 is around $13,900, while those aged 65 and older have a median net worth of $266,400. These figures highlight the importance of early financial planning and consistent wealth-building strategies.

Age-Based Financial Milestones

Setting age-based financial milestones can help you track your progress toward building net worth. For example:

- By age 30: Aim to have a net worth equal to your annual income.

- By age 40: Strive for a net worth of three times your annual income.

Net Worth of Celebrities

Celebrities often command staggering net worth figures due to their high earnings and lucrative deals. However, their net worth can fluctuate based on investments, expenses, and career longevity.

Bio and Financial Data

| Name | Age | Net Worth | Profession |

|---|---|---|---|

| Elon Musk | 52 | $250 billion | Entrepreneur |

| Jeff Bezos | 59 | $120 billion | Businessman |

Common Mistakes in Managing Net Worth

Managing net worth effectively requires avoiding common pitfalls. Some mistakes to watch out for include:

- Living beyond your means

- Not diversifying investments

- Ignoring the power of compound interest

By being aware of these mistakes, you can take proactive steps to safeguard and grow your net worth.

The Danger of Overspending

Overspending is one of the most common reasons for a declining net worth. It's crucial to maintain a balanced budget and prioritize saving and investing.

Financial Planning for Net Worth Growth

A solid financial plan is essential for sustained net worth growth. Consider working with a financial advisor to create a personalized plan that aligns with your goals and risk tolerance.

Key components of a financial plan include:

- Budgeting

- Retirement planning

- Tax strategies

The Importance of Long-Term Vision

Having a long-term vision for your financial future is vital. By setting clear objectives and consistently working toward them, you can achieve significant net worth growth over time.

Conclusion

Understanding how much net worth you possess is crucial for achieving financial stability and independence. By calculating your net worth, identifying factors that affect it, and implementing effective strategies to increase it, you can take control of your financial destiny.

We encourage you to take action today by assessing your current financial situation and setting realistic goals for the future. Share your thoughts or questions in the comments below, and don't forget to explore other informative articles on our site to enhance your financial knowledge.

References: